While concerned with the fresh new residence’s really worth, studies have shown you to a proper-managed cellular house toward a foundation can be see in the a similar speed as the web site-situated houses. At the same time, are created property need to be built to strict HUD codes to make certain quality, thus buyers will get a secure, well-situated household by heading it station.

Of course, if your local housing market is quite aggressive, to invest in a manufactured domestic shall be a means to bypass new putting in a bid conflicts and get a brand name-the fresh, breathtaking home with less anxiety.

Zero, the FHA does not require one individual or find the property where your are produced family commonly remain. You can get a manufactured home and you will lease the latest land for the that it often stand.

FHA the incorrect complement? Check out option manufactured home loans

FHA funds are not right for everyone. Luckily, you can find almost every other financing programs where you can buy were created belongings.

Conventional

A normal financial is certainly one perhaps not backed by government entities, but alternatively controlled by authorities-paid businesses (GSEs) Fannie mae and you may Freddie Mac. Particular antique funds enables you to put down only 3% towards the a house.

In lieu of FHA money, traditional financing applications allows you to buy a made home because an additional family. So if you want to buy a double-large inside a coastline people due to the fact a vacation assets, old-fashioned will be the way to go.

Virtual assistant

The fresh U.S. Company out of Pros Issues (VA) backs home loans to possess being qualified pros, active-obligation armed forces, and you will qualified enduring spouses. Virtual assistant consumers who possess full entitlement can obtain property that have 0% down. Individuals with partial entitlement may be entitled to 0% off as well, built how much entitlement they have readily available while the purchase price of their home.

To get a manufactured house with an effective Va mortgage, the home should be into a long-term base and should getting detailed since real-estate to your regional town (unlike being categorized as a vehicle or low-permanent framework). The financial institution may require that show your vehicles name has been got rid of.

USDA

http://www.clickcashadvance.com/installment-loans-mn/austin/

The fresh U.S. Institution of Farming (USDA) backs money to own are manufactured property in the specific elements having relatively low density (both suburban and rural). USDA fund enjoys money limits, as they are built to offer homeownership certainly lowest- and you can modest-income individuals. USDA finance has actually a great 0% deposit requirement and versatile borrowing direction.

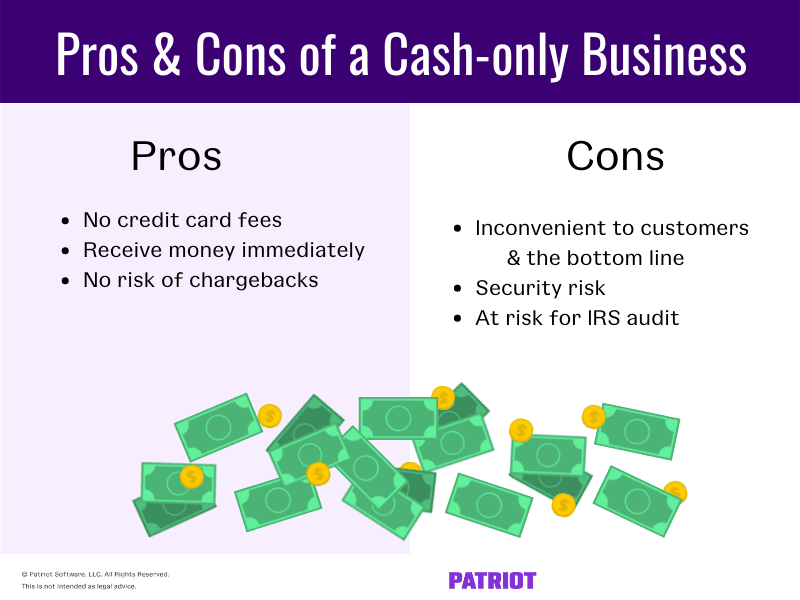

Chattel loans

Chattel fund was a type of financing covered only of the are built domestic, perhaps not the fresh belongings on which they is. In the event chattel funds could be the most frequent types of are made household loan, discover prospective drawbacks, such as for example highest rates.

FHA are made home loans Faqs

Yes, FHA financing shelter are formulated land. For folks who meet with the borrowing from the bank and you can borrower criteria, you might be able to utilize an enthusiastic FHA financing to finance your house while the property on what it can remain.

Some old-fashioned loan providers may offer 31-seasons terms and conditions on a made financial. FHA Identity We are available home loans enjoys an optimum loan title of two decades.

Several type of loans are around for are available house. The newest FHA the most beneficial due to the reasonable step three.5% down payment, versatile credit ratings, and you can glamorous words. However, people finding a produced home may also check out Virtual assistant, USDA, and you may traditional financing whenever they meet the requirements, along with chattel money.

Beat the new putting in a bid wars

Are made home can be more affordable compared to-website belongings and may give houses choices in case your interest in homes towards you are brutal. When you find yourself in the market for a produced home, FHA are made lenders promote attractive words and you will low-down percentage criteria.